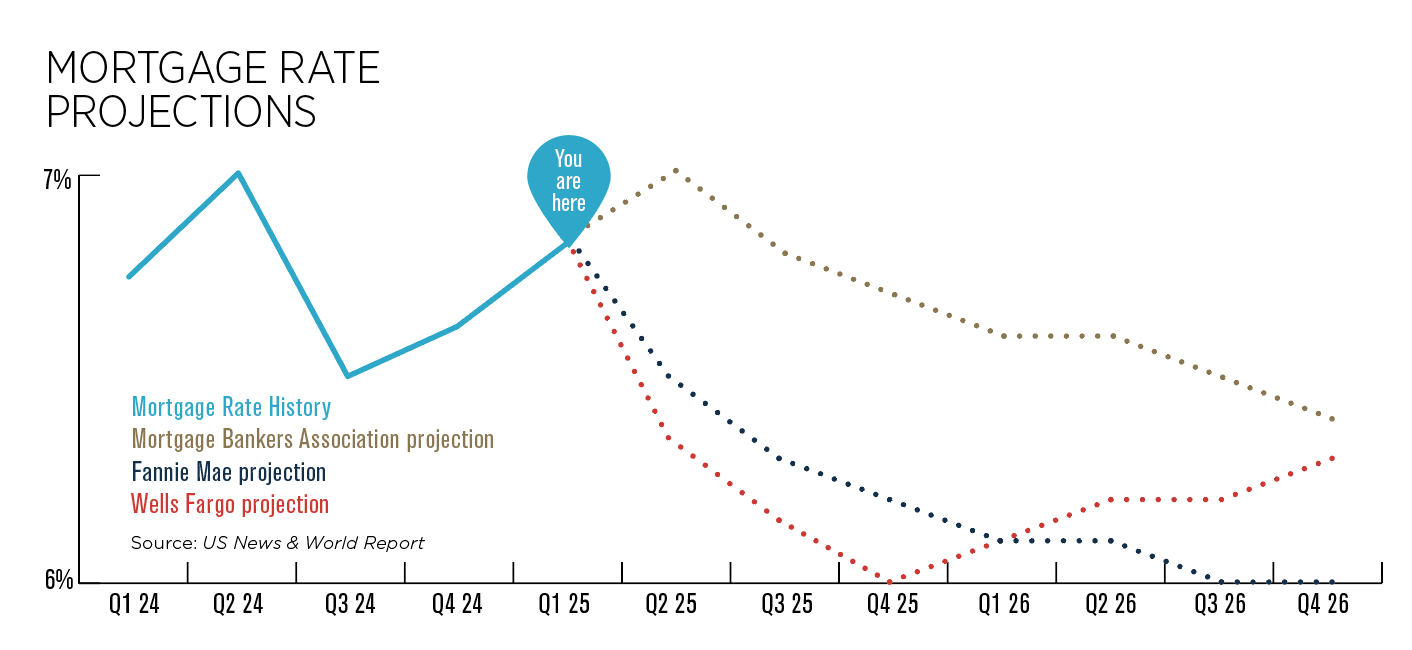

Mortgage rates—just like other leading economic indicators—are being buffeted by the combined effects of the tariff/trade escalations, interest rate policy and a strained job market. Several sources project that the average weekly rate for a 30-year fixed mortgage will remain between 6% and 7% for the next two years, with an average rate around 6.5% for the remainder of 2025 if the overall economy remains stable. A possible recession, however, could force rates down.

Some would-be buyers mistakenly tie the interest rates set by the Federal Reserve Board’s panel, the Federal Open Market Committee, with mortgage interest rates, but mortgage interest rates are more beholden to the bond market. Still, Lisa Sturtevant, chief economist at Bright MLS, says, “Lower rates are good for homebuyers who have been waiting for mortgage rates to come down. But if rates come down because the labor market is weaker and people are worried about their jobs, those lower mortgage rates won’t be able to bring as many homebuyers into the market.”