Short List

Counting Counties

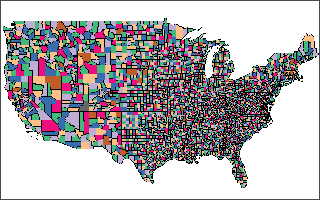

One-third of U.S. counties analyzed by RealtyTrac are less affordable now than they were in 2000, a company report finds. The report calculated both the percentage of median income needed to make monthly payments on a median-priced home in each county in May 2014, as well as the historical trend in each countys income-to-price affordability percentage going back to January 2000.

The good news is that none of the nearly 1,200 counties we analyzed for the second quarter has regressed to the dangerously low affordability levels reached during the housing price bubble, and even if interest rates increased 1 percentage point, only 59 counties, representing 2 percent of the U.S. population, would be at or above bubble levels in terms of affordability, says Daren Blomquist, vice president at RealtyTrac.

But the scales are beginning to tip away from the extremely favorable affordability climate weve seen over the last two years, with one-third of the counties analyzed representing 19 percent of the total population in those counties now less affordable than their long-term averages.

And what about those pesky kids?

RealtyTrac released a scorecard ranking the most-affordable and the least-affordable housing markets for members of Generation Y (born after 1980) in the U.S. Not surprisingly, counties in California and New York take the top five spots on the least affordable list.

| Least Affordable | |

|---|---|

| Los Angeles County | 5 |

| Bronx County (NY) |

4 |

| Kings County (NY) |

3 |

| New York County | 2 |

| San Francisco County | 1 |

| Most Affordable | |

|---|---|

| Richmond County (GA-SC) | 1 |

| Cumberland County (NC) | 2 |

| DeKalb County (GA) | 3 |

| Duval County (FL) | 4 |

| Philadelphia County | 5 |