Depleted Inventory in the Housing Market

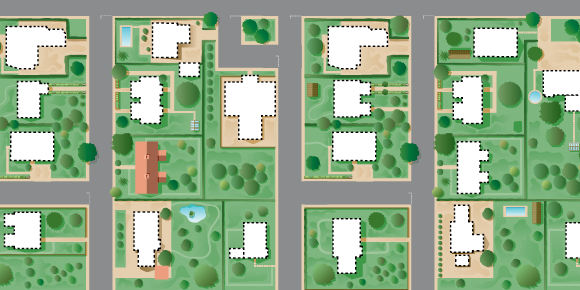

A study conducted by the National Association of REALTORS® reveals that although metro areas are seeing positive job growth, they continue to face a shortage in housing. The study measured the volume of new home construction compared to the amount of newly employed workers across 146 U.S. metro areas over a three-year period. The results show that homebuilding activity for all housing types is behind in roughly two-thirds of the 146 metro areas studied.

In the past, the average ratio for the annual change in total workers to total homebuilding permits was 1.6 for single-family homes. The study found that through 2014, 72 percent had a ratio above 1.6, which indicates inadequate new construction.

The report also finds that the homebuilding industry continues to face challenges such as rising construction and labor costs, limited credit availability for smaller builders and concerns about the re-emergence of first-time buyers. The lack of homes available is creating more competition among a growing number of buyers and continues to drive home prices up, especially in major metro areas.

In addition to slow housing turnover and the diminishing supply of distressed properties, lagging new home construction especially single family has kept available inventory far below balanced levels, says NAR chief economist Lawrence Yun. Our research shows that even as the labor market began to strengthen, homebuilding failed to keep up and is now contributing to the stronger price appreciation and eroding affordability currently seen throughout the U.S.

The metro areas with the largest disparity of jobs versus new construction (inadequate supply) are:

- San Jose, California

- San Francisco

- San Diego

- New York

Metro areas with adequate home supply-to-job ratios are:

- Jackson, Mississippi

- Colorado Springs, Colorado

- Chattanooga, Tennessee

- Amarillo, Texas