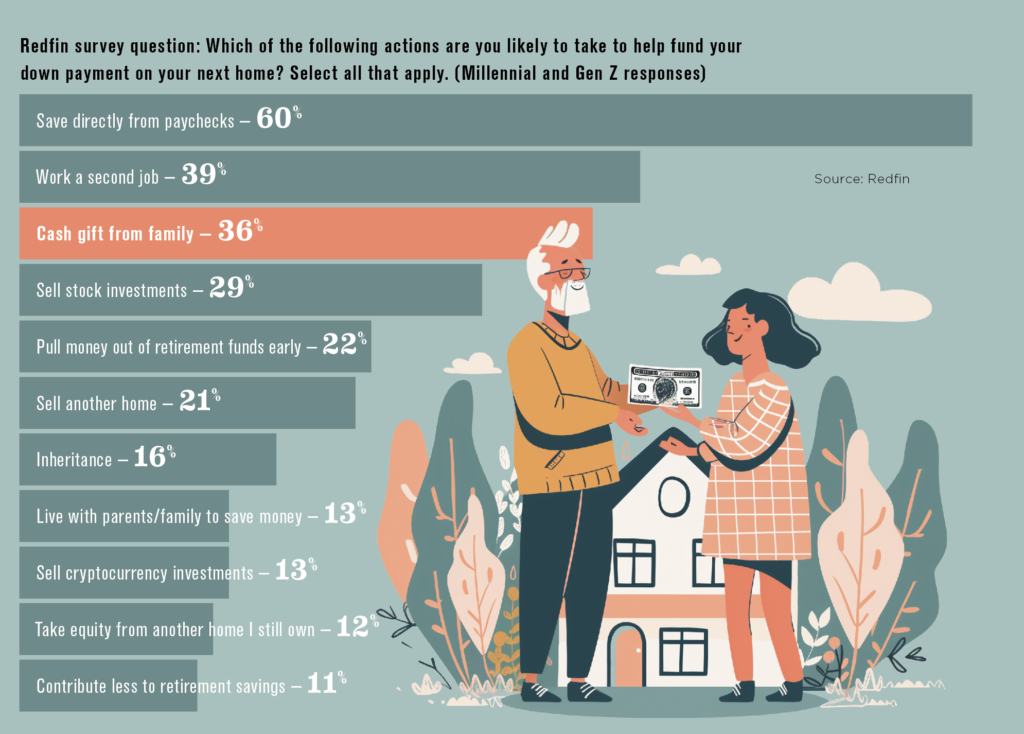

A recent survey from Redfin reports that a higher proportion of Gen Zers (born 1997–2012) and Millennials (born 1981–1996) will be accepting help from their families to fortify their home down payments. Saving from primary income is still the leading method used by 60% of respondents, followed by income from a second job (39%). Accepting a cash gift from family is the third most cited source for down payment funds, with 36% of respondents saying this is how they will proceed.

This marks a change from five years previous when only half as many (18%) respondents in the Millennial cohort said they’d be getting cash from family. That figure jumped to 23% in 2023. (Gen Z was added to the survey in 2024.)

None of this is surprising considering the lack of affordable starter homes nationwide— average home prices are 40% higher than before the pandemic. People who don’t have access to help from parental coffers are being priced out of the market.

“Nepo-homebuyers have a growing advantage over first-generation homebuyers. Because housing costs have soared so much, many young adults with family money get help from Mom and Dad even when they have jobs and earn a perfectly respectable income,” says Redfin Chief Economist Daryl Fairweather.

Photo: ridvan_celik E+ via Getty Images