The pandemic has caused turmoil in the commercial real estate market. Many companies have transitioned from office work to working from home, resulting in lost revenue for building owners from lack of tenants. But there may be a profitable solution for these vacant office buildings: converting them to residential units.

To better understand this real estate pivot, the National Association of REALTORS® (NAR) commissioned a study, “Analysis and Case Studies on Office-to-Housing Conversions,” published in November 2021. Here are a few of the key findings from that report:

- To determine if a conversion is economically feasible, the apartment revenue generated (Class A) must be higher than current Office Class B/C rents. The report concluded that “22 out of 27 metros heavily impacted by the pandemic have market conditions that make office-to-housing conversions feasible.”

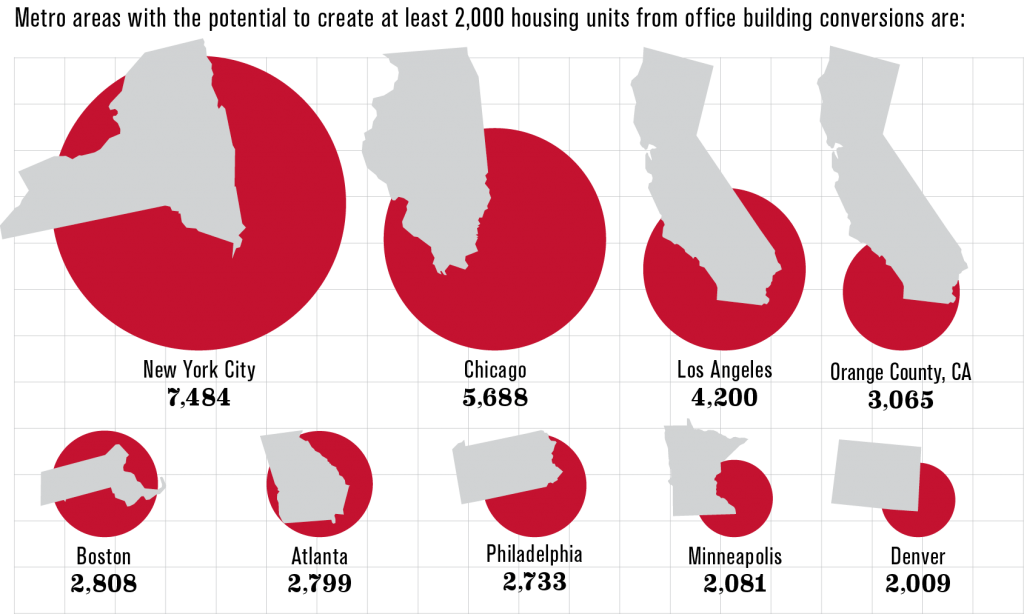

- Using data collected, NAR estimates that 43,500 housing units can be created if 20% of all vacant office building square footage is converted into housing. The result is an average size of 1,000 square feet per unit. (This number was determined using information from the U.S. Census Bureau, which stated that in 2020, the median family-rented residential unit is approximately 1,075 square feet).

To read the report in full, along with several successful case studies regarding this practice of commercial-to-residential real estate conversion, visit NAR.realtor/research-and-statistics.

Photo: iStock.com/RapidEye