Being prepared for retirement should always be top of mind for veteran agents in the industry

By Myrna Traylor

All information shared here is based solely on the opinions of those quoted and should not be taken as financial advice. Seek out a professional financial planner to assess your financial situation and retirement plans.

Whether your retirement is something in a hazy, far-off future or is barreling toward you at breakneck speed, there are ways to ensure you have enough money set aside to spend your nonworking years in relative comfort.

Whether your retirement is something in a hazy, far-off future or is barreling toward you at breakneck speed, there are ways to ensure you have enough money set aside to spend your nonworking years in relative comfort.

Real estate agents—like everyone else—can fall into one of two categories when it comes to planning for retirement: those who want to live every year as lavishly as their income allows and those who are happy to live frugally now so they can retire with peace of mind and a really nice nest egg.

No matter which camp you fall into, you can make choices—the earlier, the better—that will bolster your financial position when it’s time to hang up your blazer.

Your investments

A good way to get started investing in your future is to go with what you know: real estate. Acquiring one or more investment properties will provide passive income for as long as you control them. Jennifer Viger, CRS, broker owner at Market House Realty in Augusta, Georgia, sees real estate as an ideal investment. “I’ve come to the realization that there’s nothing guaranteed for retirement,” she says. “One of the things that I love about real estate, though, is that it’s not some random, intangible stock. Everybody needs a place to live.”

Being in the real estate business brings certain tax advantages when it comes to investment property. Eric Ravenscroft, CRS, sales agent at The Ravenscroft Group | Real Broker in Buckeye, Arizona, shares a helpful tip. “I’m still shocked there’s so many agents that don’t own a property or have rentals generating income for them,” he says. “Agents are able to take advantage of cost segregations or bonus depreciation to potentially offset a large portion of their taxable income so they’re not paying a tax on it. That’s the benefit real estate agents have that other people don’t have.”

Cost segregation or bonus depreciation allows real estate professionals to write off the depreciation on their properties in a way that can lower their income tax payment. As Ravenscroft describes it, an agent-owner can “front-load a larger portion of the write-off in a year where you’re making a lot of money. So, instead of taking $8,000 [depreciation] every year, I’ll take $40,000 this year, but then every year after that, I’ll take $4,000 or $5,000 because I front-loaded that discount.”

Cost segregation or bonus depreciation allows real estate professionals to write off the depreciation on their properties in a way that can lower their income tax payment. As Ravenscroft describes it, an agent-owner can “front-load a larger portion of the write-off in a year where you’re making a lot of money. So, instead of taking $8,000 [depreciation] every year, I’ll take $40,000 this year, but then every year after that, I’ll take $4,000 or $5,000 because I front-loaded that discount.”

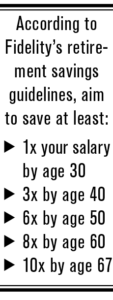

While owning investment properties may feel like a natural fit for agents, retirement vehicles such as IRAs and 401(k) plans can broaden your retirement portfolio. A Solo 401(k), also known as an Individual Solo 401(k), is a retirement plan designed specifically for small business owners without any W2 employees, except for themselves or their spouse. It offers significant advantages in terms of employee contributions. Tim Tepes, CRS, associate broker at Tim Tepes Real Estate LLC powered by Better Homes and Gardens Real Estate Cassidon Realty in Northampton, Pennsylvania, is fond of quoting Albert Einstein. “[Einstein] said, ‘the Eighth Wonder of the World is compounding interest.’ Pick big blue-chip companies that aren’t exciting—for instance, companies that make everyday products and pay a constant dividend. There’s also a thing called the ‘dividend aristocrats.’ Look those up and purchase stock in those companies or buy a good index fund; you’ll be in great shape.

“The biggest thing about making money is time,” says Tepes. “You don’t have to be smart; you just have to have patience and time. The younger you start, the better off you’ll be.”

Your book of business

Unless you own a brokerage that you can sell outright, you may see your customer database as an asset that you can offer to another agent as you get closer to retirement. “Most agents don’t have the money to just write you a check for, say, $300,000 for your book of business,” says Monica Neubauer, CRS, broker associate at Benchmark Realty LLC in Franklin, Tennessee. “The majority of people will do it with a referral arrangement or other shared compensation model. Let’s say, if I bought your book of business, for the next five years, everybody I work with from your database, I’ll give you a certain percentage.”

Tepes says that having a referral-based business will provide you with options before, during and into retirement. “If you build a good database and stay in contact with those people, you could retire, keep your license and referral network, and just refer people to other agents who’ll pay you a commission referral fee for the lead.”

Tepes says that having a referral-based business will provide you with options before, during and into retirement. “If you build a good database and stay in contact with those people, you could retire, keep your license and referral network, and just refer people to other agents who’ll pay you a commission referral fee for the lead.”

“An agent who has done a good job over the years is going to continue to get calls, and they should plan how they want to transition their business in order for it to be successful,” says Neubauer. An important part of that transition, however, is making sure that clients are comfortable with the person who is taking over. Working together as partners for a few months or years can help your clients become familiar with the new face.

“And take the Succession Planning class from the RRC,” says Neubauer. “Start planning sooner rather than later to maximize your benefits.”

Your retirement off-ramp

Give yourself enough runway to get the kind of exit you want. Brad Staplin, CRS, broker and certified professional coach with BSA Realty Group in Roseville, California, outlines three ways to leave work behind and recommends at least a five-year lead time. “One of the options that a lot of agents choose is to stay partially involved in their business. In that case, you need to have someone qualified to take over at least part of the business. Plus, you’ll need to agree on exactly what ‘partial’ will mean; how involved will you be?”

The second option is to do a full sale, making sure your CPA and attorney have helped you get your affairs in order.

The third scenario is something less than an option and more akin to a sudden need. “If an illness, life event or burnout strikes out of the blue, people say, ‘Alright, I’m closing my doors in three years. How am I going to prepare my life to do this?’ That option is not necessarily ideal financially,” but can be optimized with help from a strong successor and good professional assistance.

Amid all this planning, don’t forget to think about how you will actually spend your time. Will you golf your days away, travel or commit more fully to those community projects you love? It’s your future—make it as bright as possible.

Retired or Not?

When Quin O’Brien, CRS, decided it was time to retire, he crafted a proposal for two of his agents to buy his business. “I set a price that would make me sufficiently happy, but I structured the deal in an easy-to-accept format. I said, ‘I want you guys to get established and succeed, so don’t even make your first payment for one whole year.’” The agents accepted the deal, O’Brien retired and moved with his wife to the Canary Islands, Spain.

But then he “un-retired” and worked for a real estate company there. Now, the couple are back in Illinois for six months of the year. “My initial goal was to retire in Spain and explore Europe on the cheap. But I’ve got kids and grandkids here, my wife has nieces, nephews and parents over there, so I’ll be bouncing between the two locations. But I utilize all that knowledge here. I now help Spaniards come here to become bilingual teachers and find them homes to purchase.”

Plan for your future with our RRC course recording, Retiring? What’s My Business Worth?, available at www.CRS.com/education.

Photo: Getty Images/DNY59