Buyer’s remorse can hit any client at any time—and agents need to be prepared to help reconcile these feelings and doubts

By Michelle Huffman

You guided your buyers through dozens of homes and put offers on many of them, but ultimately lost out.

Your buyers are exhausted and frustrated. Finally, they put in an offer that’s accepted. Everyone celebrates—a win! A home! Finally!

Your buyers are exhausted and frustrated. Finally, they put in an offer that’s accepted. Everyone celebrates—a win! A home! Finally!

Then the doubt sets in.

When the thrill of the chase fades, your buyers are racked with remorse. The kitchen needs a lot of work. The location isn’t ideal. The monthly payment feels like too much. They won the bid, but they didn’t get the home of their dreams.

Now what?

This scenario is playing out in markets across the country, driven by limited inventory that requires buyers to make big decisions with lots of compromises at warp speed.

“Buyer’s remorse is much more common in this superheated market we’re currently experiencing,” says Judy Barrett, CRS, REALTOR® in Kailua, Hawaii.

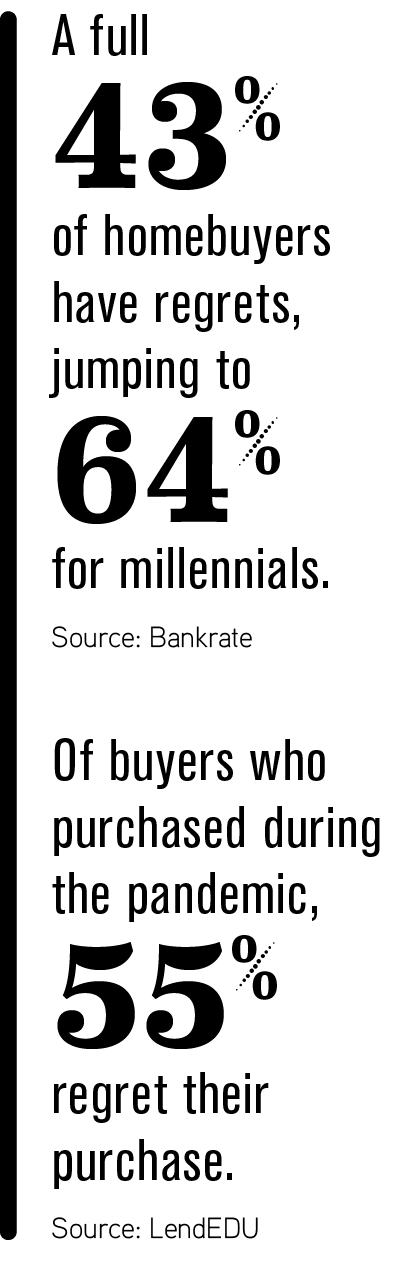

According to a spring 2021 Bankrate survey, a full 43% of homebuyers have regrets, and that figure jumps to 64% among millennials. Another study conducted by lender LendEDU in 2020 found that 55% of buyers who purchased during the pandemic regret their purchase.

That’s some serious buyer’s remorse. This issue doesn’t just impact buyers; it impacts agents, as well.

“For seasoned agents, buyer’s remorse issues prior to the pandemic were probably 5% or less, but that was then,” says Tony Moore, CRS, with Moore and Co. Realtors in Russellville, Arkansas. Now he puts the number at 10% for these agents.

“Newer agents, those in the business for three years or fewer, could see 20% to 30% of their potential gross income evaporate in this one single category in the next 12 months,” he adds.

Prepare buyers for the market

It may seem gloomy, but prepping buyers for the amount of compromises they must make, the competitiveness of the current market, the reality of their price range and the total cost of ownership can significantly reduce the potential for buyer’s remorse.

“Have the tough conversations upfront, and let them know the challenges they will be facing,” says Jennifer Hunt, CRS, with Berkshire Hathaway Home Services NE in Southington, Connecticut. “They need to know what they really want. Are they willing to give up some space in the kitchen for a larger backyard or vice-versa?”

It’s also important to address the emotions that will come up during the buying process. According to a FlyHomes survey, 58% find the buying process stressful. It’s important that buyers know that stress is normal—and not indicative of the decision they’re making about their home.

That’s why it’s also key to normalize buyer’s remorse.

Prepare buyers for potential remorse

Preparing buyers upfront to have cold feet or feel some regret when they buy may seem counter-intuitive, but managing these feelings ahead of time can minimize them when they crop up.

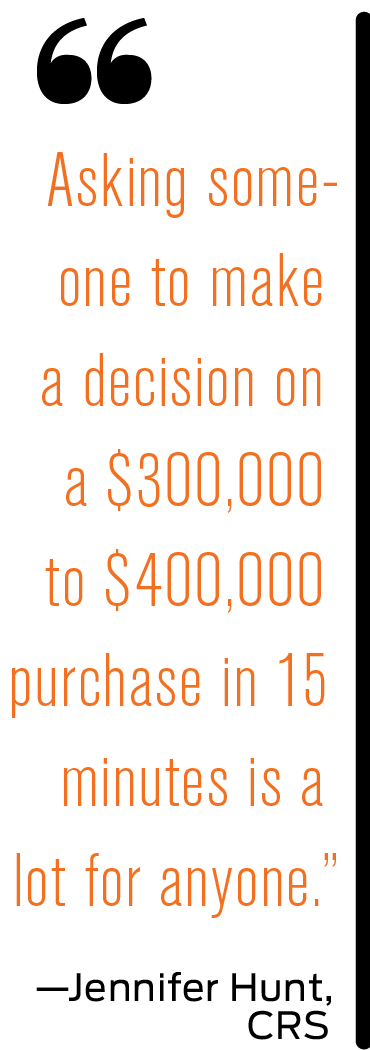

To help buyers, Hunt books two showings at the same high-potential house on the same day. Showings book up fast, and she wants her buyers to be able to see the house again before writing an offer. This takes the pressure off. “Asking someone to make a decision on a $300,000 to $400,000 purchase in 15 minutes is a lot for anyone,” she says.

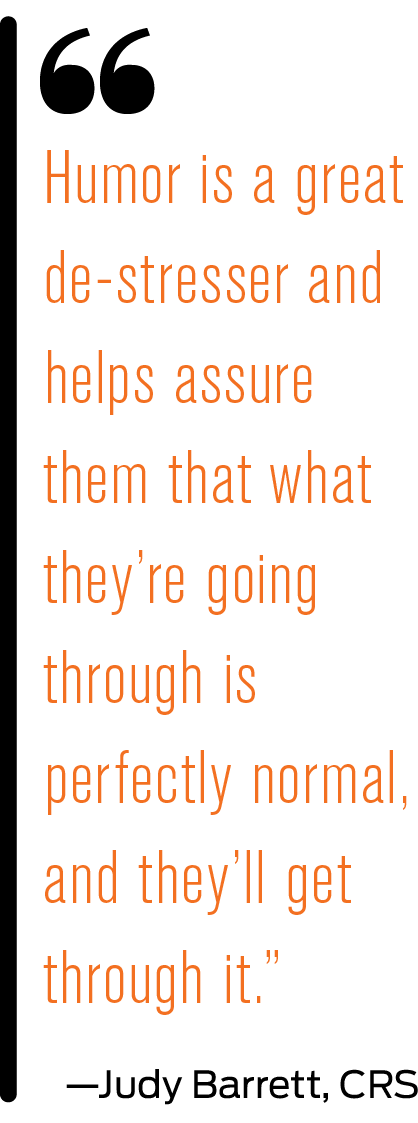

Barrett’s solution comes in the form of jellybeans, which she dispenses in a prescription-style bottle, purchased online and bearing a custom label, joking that these pills will ease the predictable home-purchasing pain.

“Humor is a great de-stresser and helps assure them that what they’re going through is perfectly normal, and they’ll get through it,” she says.

Moore agrees: “I typically say, ‘It’s very normal to have butterflies in your stomach after making a major investment like a new home. Sometimes, at 2 a.m., they seem more like B-52 bombers than butterflies. Let me assure you now, this is very normal.’”

He also walks them through all the reasons they wanted to purchase the home in the first place, helping them emotionally reconnect with the property.

Finally, Barrett likes to remind them that they can, in fact, get out of the contract unscathed if the inspection turns up serious issues with the property, which is reassuring and helps them avoid feeling trapped, she says.

Regardless of how they handle it, agents who confront this problem head on will likely be glad they did because the trend doesn’t appear to be reversing anytime soon.

“We are going to be learning a new normal: the hangover from COVID-19 and all the changes surrounding it,” Moore says. “Don’t be surprised if this problem continues for the next three or four years.”

A Different Kind of Buyer’s Remorse

In super competitive markets, a new kind of buyer’s remorse is emerging: the remorse of not buying a home.

This is the kind of remorse Matthew Plummer, CRS, with MVP Realty Group in Olympia, Washington, is seeing more often, particularly with first-time buyers.

Prepare them as he might—telling them that it will likely take six months to a year to find a home, citing the stats on how often homes sell above asking and sharing stories of clients who missed opportunities—most buyers have to go through the process and experience firsthand what it’s like to lose, often several times over.

To help would-be buyers deal with this kind of buyer’s remorse, Plummer recommends:

1. Backing off his clients’ max budget—in his case by about $40,000—to make room for a winning offer because so many homes are selling for above list price.

2. Advising clients to make a “no regrets” offer. “This is the absolute all you’d be willing to pay for this particular property,” he says. “If you’d be disappointed if someone won this property for $1,000 more than what you offered, then you haven’t offered your best offer.”

3. Encouraging clients to be prepared for what it might take to get there. For example, how much cash can they offer? Do they need a gift from their parents to cover a price that doesn’t appraise?

4. Going through possible outcomes with clients early on in the process. “Hindsight is 20/20,” he says, “I try to give my clients as much hindsight as possible upfront.”

For more tips on managing new-buyer anxiety and other valuable tools to create an enjoyable buying and post-buying experience, check out the First Time Home Buyers eLearning course at CRS.com/catalogsearch.

Photo: iStock.com/GeorgePeters