Experts share how blockchain technology can be beneficial to real estate agents and the industry at large

By Regina Ludes

Kathleen Ryan, CRS, knew nothing about blockchain until her son mentioned it in conversation five years ago.

At the time, Ryan, a REALTOR® with RLAH Real Estate in Washington, D.C., dismissed the idea. When it became widely discussed a few years later on Clubhouse, an audio-based social network she belongs to, the light bulb went on.

“I knew it would be valuable to real estate because of its immutability,” says Ryan, who speaks and teaches agents about cryptocurrency and blockchain technology. She also plans to use smart contracts for her business. “Once a transaction is recorded on the blockchain, it cannot be changed. Further, it speeds up transactions. You can see signed contracts as soon as they’re recorded.”

While blockchain has been around for only a decade, it has stirred up debate about its potential impact in the real estate industry. Many tech-savvy agents are bullish on the new technology, while others are slow to adapt to it or believe it’s a fad. Blockchain has a unique lexicon and complex way of operating, which makes it difficult for many people to understand. However, experts believe it’s only a matter of time before blockchain will be as familiar as email. CRS agents who understand how blockchain works and its potential impact on real estate can position themselves as the go-to agent for the next generation of homebuyers and sellers.

What is blockchain?

The simplest explanation: “Blockchain is a new way of storing and sharing transaction information. It’s different from a regular database in that once the information is recorded, it becomes permanent and can be immediately reviewed by all parties,” says Dave Conroy, director of emerging technology with the National Association of REALTORS®.

Blockchain adoption in real estate has been slow due to the educational gap among agents and misinformation about it, says Conroy. “There aren’t enough incentives to adapt to it until it’s further tested,” Conroy says.

Blockchain makes transactions more transparent and reliable, adds Tim Kinzie, CRS, with Montlor Luxury Realty in Cary, North Carolina. “If a group of people are in a room, and one person gives a $10 bill to someone else in the room, everyone there would see the transfer of money,” he says. “It shows consensus that the transaction took place. It makes plagiarism, fraud and counterfeiting nearly impossible.”

Mortgage lending and title insurance companies are most likely to be affected by blockchain because those businesses involve record keeping and document processing, he adds. Many current transaction processes are outdated and complicated. Contracts and other legal documents can go back and forth multiple times between parties, which is time-consuming and costly. There’s always a chance that a document can be lost, misplaced or destroyed. However, since blockchain keeps a history of every transaction and time stamps documents, that information can never be lost or disputed.

Use of cryptocurrency

Kinzie first learned about blockchain nearly a decade ago when he made his first investment in bitcoin, a type of digital currency that is part of the blockchain. Since then, he has invested in virtual properties and cryptocurrency. He is beginning to see signs of blockchain’s impact in his market among younger homebuyers, who are increasingly cashing in cryptocurrency to fund down payments.

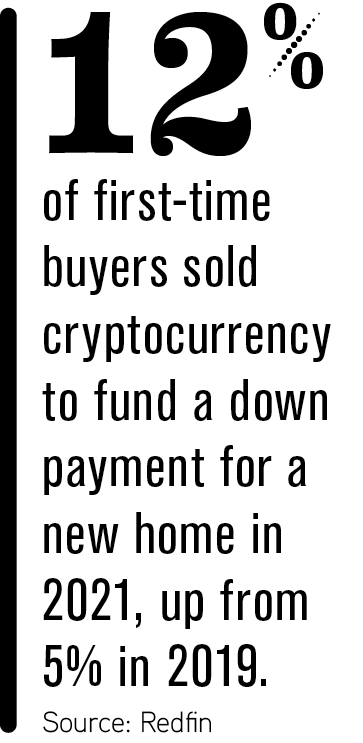

That dovetails with a recent survey by Redfin that found that nearly 12% of first-time buyers sold cryptocurrency to fund a down payment for a new home in 2021, up from 5% in 2019. Cashing in cryptocurrency can be a smart move for some buyers because it increases their purchasing power. “Instead of buying a $400,000 home, they can purchase one for $500,000,” Kinzie says.

That dovetails with a recent survey by Redfin that found that nearly 12% of first-time buyers sold cryptocurrency to fund a down payment for a new home in 2021, up from 5% in 2019. Cashing in cryptocurrency can be a smart move for some buyers because it increases their purchasing power. “Instead of buying a $400,000 home, they can purchase one for $500,000,” Kinzie says.

Ryan believes that recent buyers have probably been converting their cryptocurrency into cash for housing down payments all along, but never revealed that detail with their agent. “They’ve been more open about it because they’ve had to stretch their resources,” Ryan says.

However, lenders and attorneys differ in their level of acceptance of cryptocurrency for real estate transactions. Ryan advises agents to become familiar with changing regulations in their state so they can counsel their clients accordingly.

Implications for real estate

Conroy cites four areas of impact for real estate:

Proof of ownership. By recording ownership of a property, blockchain provides verifiable proof of who owns that property, for how long and when it was transferred to that person.

Payment processing. Whether payments are for rent, escrow or purchase agreements, blockchain creates a record for every payment processed. It can reduce settlement time to mere seconds instead of days, and transaction fees could be reduced to pennies, even with international buyers.

Payment processing. Whether payments are for rent, escrow or purchase agreements, blockchain creates a record for every payment processed. It can reduce settlement time to mere seconds instead of days, and transaction fees could be reduced to pennies, even with international buyers.

Smart contracts. In traditional transactions, contracts can often go back and forth among all parties for review, which can take time. Smart contracts are not digital representations of legal contracts, but instead are snippets of computer code that run along the blockchain to automatically trigger actions or next steps in the real estate transaction. For example, when all required signatures are received on a purchase agreement, it can trigger the payment of funds for escrow.

Fractional property ownership. While most transactions involve a single person buying or selling an entire property, with blockchain, it’s possible for multiple parties to own portions of a property. Fractional ownership increases access to a real estate investment by lowering the minimum amount of capital needed to purchase property. It also allows property owners to sell partial equity, which provides immediate liquidity.

“People can create ownership rights through cryptocurrency for an apartment building, sort of like a stock,” Kinzie says. “For example, you might own 1/1000th of a building through a token without going through typical fractional ownership avenues.”

Opportunities for agents

Ryan says agents who are knowledgeable about blockchain can differentiate themselves in their market. “Blockchain has created a new area of expertise for agents. If you don’t know anything about blockchain or bitcoin, and clients ask about it, you might have to refer the client out,” she says.

While blockchain adoption will be slow and steady over the next five years, Conroy says a REALTOR®’s role isn’t likely to change. “Technology can’t replace the expert knowledge of a REALTOR®,” he says.

The Language of Blockchain

Half the battle of understanding blockchain is becoming familiar with its terminology. Here are a few basic terms to know.

Bitcoin — The first cryptocurrency created in 2009. Built on the bitcoin blockchain.

Blockchain — A public, decentralized ledger that records information in digital blocks. Once a block is mined and added to the chain, it can’t be altered.

Cryptocurrency — A digital currency or a token that’s native to a blockchain. Cryptocurrencies are typically minted with each new block mined.

DeFi — Decentralized finance. Any financial tool, such as a smart contract, that uses blockchain technology to circumvent the middleman.

Smart contract — A digital contract that executes next steps when required conditions are met. Most commonly used to automate transactions.

Source: CNET.com

RRC is debuting a new webinar about cryptocurrency and blockchain this October. Register today at CRS.com/webinars.

Photo: iStock.com/AGouldDesign/xorosho/PeterPencil/hakule