By Annika Tourlas

Natural disasters are testing the strength and resilience of our communities, and the real estate market is feeling the pressure. Real estate professionals are having to help buyers, homeowners and sellers navigate the complexities of living in a region with a high natural disaster risk.

It’s time to understand how these events reshape property values, insurance accessibility and buyer expectations; it’s essential to keeping everyone safe, secure and confident in their real estate decisions.

The Shifting Landscape: Disasters and Market Impact

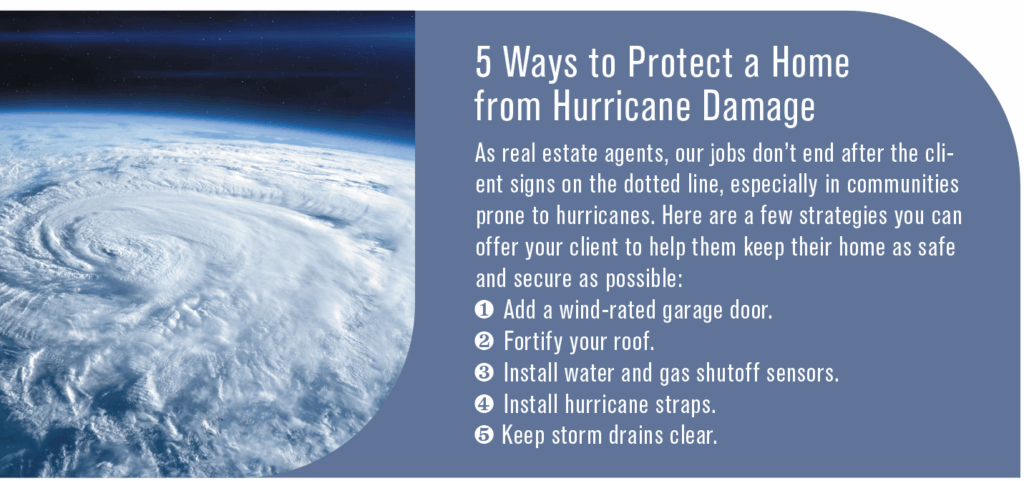

Natural disasters have the potential to create uneven markets, often needing years to bounce back to stability. In recent years, hurricanes and wildfires have caused short-term drops in demand and a surge in damaged properties hitting the market all at once. While prices may fall at first, several factors can drive them back up, such as:

- Rebuilding efforts

- Limited supply of turn-key homes

- Increased insurance rates

- Changing demands for levels of coverage

“We had a direct impact here in southwest Florida with Hurricane Ian about two and a half years ago,” says Carrie Ciolino, CRS, real estate agent at Royal Shell Real Estate in Cape Coral, Florida. “It was quite different from the past experiences I’ve had here in my whole lifetime because we had a surge. … It did take a big hit, and for our real estate market, initially, it was pretty devastating.”

“We had a direct impact here in southwest Florida with Hurricane Ian about two and a half years ago,” says Carrie Ciolino, CRS, real estate agent at Royal Shell Real Estate in Cape Coral, Florida. “It was quite different from the past experiences I’ve had here in my whole lifetime because we had a surge. … It did take a big hit, and for our real estate market, initially, it was pretty devastating.”

Throughout the country, communities of all landscapes face natural disasters. Yet, despite all the risks, communities still recover, and new buyers still flock to desirable regions to live out the life they’ve always had in mind. While many areas have limited properties, even in regions hit the hardest, inventory is rising and so is the demand.

“We constantly have buyers coming to our area from all over the country,” Ciolino says. “They didn’t directly see the impacts; they didn’t go through the storm. So, as a couple of years have passed, they ask questions, but it’s not holding them back.”

Insurance and Affordability Challenges

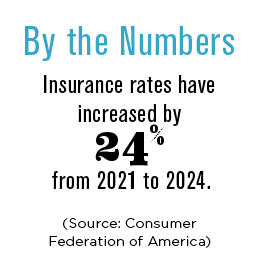

Insurance is emerging as a major barrier to stability in climate-vulnerable markets. According to the Consumer Federation of America, insurance rates increased 24% from 2021 to 2024. Homeowners can see even larger increases in areas vulnerable to floods, wildfires or hurricanes. Annual insurance costs in some neighborhoods have turned once-affordable homes into financial burdens.

“One of the things that we have in our high-risk areas is higher insurance costs,” says Sandra Swanson, CRS, associate broker at Key Allegro Real Estate in Rockport, Texas. “After Hurricane Harvey, the few private insurers that we had left the area. We’re now just down to the one FEMA (federal government). Since Harvey, our premiums have gone up every year.”

This is especially tough on first-time buyers, where even a few hundred dollars in added costs can break a budget. Many lenders are tightening standards, often requiring:

- Proof of insurability before closing

- Higher coverage limits to match elevated risks

- Lower valuations on properties in flood, fire or hurricane zones

Accurate and early disclosure is essential to avoid surprises that can derail deals. In specific regions, disclosures may include:

- Prior damage or insurance claims

- Known risks (e.g., flood history, outdated roofing)

- The potential for high ongoing insurance costs

“We have to tell buyers that they’re purchasing in a high-risk area because we have disclosures that are mandated by the state,” Swanson says. “You’re the agent for the buyer. That buyer is your client. You have to disclose these risks. And we all do.”

Buyer Behavior and the Rise of Resilient Markets

Buyer Behavior and the Rise of Resilient Markets

Buyer behavior is evolving in response to climate risk, but not in the same way for everyone. Their behaviors and real estate desires depend on age, income and motivation.

Retirees Prioritize Lifestyle with Caution

Many older adults still dream of retiring near a sunny beach. However, with a fixed income, rising insurance premiums and potential weather-related repairs, more people are weighing the pros and cons.

“So, when you look at a retiree and they’re looking and coming down here on a fixed income, higher costs for food and everything else becomes a big issue,” Swanson says. “I call it ‘the fear factor.’”

Wealthy Buyers Accept the Risk

Affluent buyers often continue purchasing in high-risk areas, knowing they can afford higher insurance premiums or invest in upgrades like impact windows, elevated foundations or fire-resistant landscaping.

First-Time Buyers Are More Cautious

In certain regions, first-time homebuyers are having to look outside flood zones and fire-prone communities due to high insurance premiums and additional expenses.

Even after major disasters, most affected markets eventually recover. Buyers return as rebuilding progresses and mitigation improves, especially for homes that offer clear signs of resilience.

What Agents Need to Know and Do

In today’s changing climate, real estate agents must be well-prepared to help clients navigate growing risks and complexities in the market:

- Know Your Risk Zones: Study FEMA flood maps, wildfire risk areas and other local hazard data to understand where properties sit in relation to potential dangers.

- Keep Learning: Stay updated on climate risks, changing insurance rules and local regulations through continuing education and industry resources.

- Guide Your Clients: Help buyers and sellers by explaining the importance of full disclosure, recommending thorough inspections and setting realistic expectations on pricing in risk-prone areas.

Whether your client is navigating the aftermath of a storm or deciding where to set down their roots, you can become the helping hand they need for a strong, resilient future by staying informed and ahead of the game.