Home pricing is a science and an art that takes into account a multitude of factors

By Michelle Markelz

It’s said that money can’t buy happiness or love, but it can buy some things that are even more important to humans.

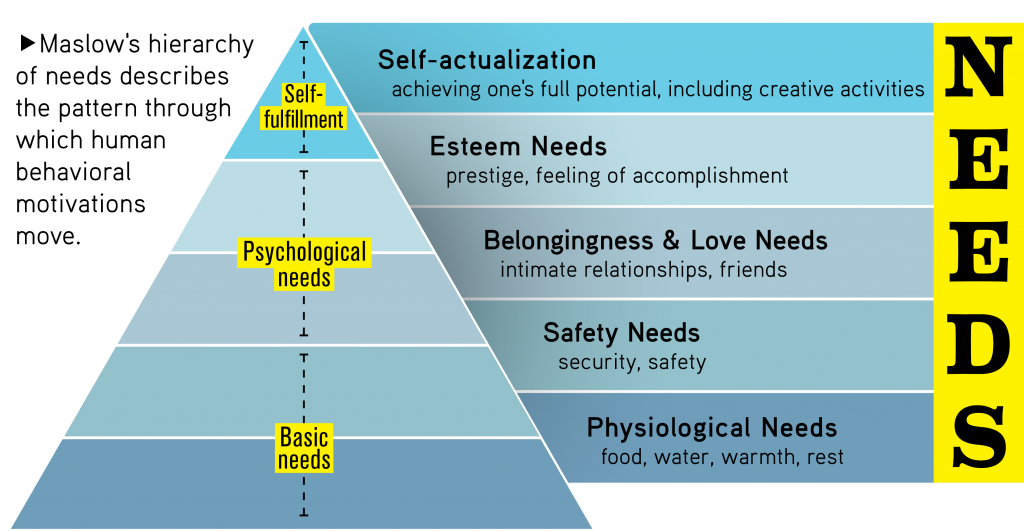

According to Maslow’s hierarchy of needs, shelter, warmth and repose are all foundational to human contentedness. “Because housing checks off so many physiological needs in the human psyche, homebuyers have been known to act irrationally,” says Khoi Le, CRS, broker and co-owner of Hunter Chase Realty in Albuquerque, New Mexico, who studied psychology.

Home pricing is both a science and an art that takes not just buyer psychology into account, but a spectrum of other factors, some of them subjective. So what’s the best pricing strategy? It depends who you ask.

What’s in a nine?

Popular psychology says that prices ending in 999 make price- conscious buyers feel like they’re getting a deal, but the amount of consideration and risk that goes into a home purchase is vastly different from that of an as-seen-on-TV gadget or everyday consumer good.

“I haven’t met a buyer who looks at a price that ends in 999 and doesn’t round up,” says Francine Viola, CRS, an agent with Coldwell Banker Evergreen Olympic Realty Inc. in Olympia, Washington. “My clients don’t fall for it.”

Rather than try to soften a price by knocking off $1, Viola suggests that round numbers are both more reassuring for buyers and beneficial for visibility in internet searches. Zillow’s search tool allows users to set price floors by $100,000 increments. Trulia provides brackets that are $50,000 apart, and Redfin uses even smaller $25,000 ranges. Pricing should always start with appraisal and comparable data, but when optimizing a list price for internet tools, it’s probably better to nudge the price closer to a standard benchmark.

Buyers looking for homes between $350,000 and $400,000 may miss a home dropped to $349,999, even though they may be much better prospects than buyers whose budget caps at $350,000. Le says $50,000 increments are the sweet spot to aim for because they can allow the seller to reach two markets. In the example of the $350,000 home, a seller using Le’s method could reach buyers whose price ceiling is $350,000 and buyers whose price floor is $350,000.

Standing out—for better or worse

There are other theories that avoid common price points altogether. Where some look at pricing brackets and see the edges, Mark Handlovitch, CRS, associate broker RE/MAX Real Estate Solutions in Pittsburgh, sees the space in between. In a sea of listings ending in 000 or 999, he believes his listings stand out. “I might price a home at $478,787 because it’s eye-catching,” he says.

Not everyone agrees with Handlovich’s theory. “The only way a seller can communicate with a buyer is through the price,” which makes the first impression critical, says Viola. “Buyers don’t trust out-of-the-ordinary prices that aren’t round numbers. It sends a signal that the seller will be difficult to work with. When we’re talking six or seven figures, and the seller’s going to put a little number at the end, what’s the point?”

Handlovitch would argue that the point is to generate uncommon interest. He recently sold a house for which the homeowner wanted to get over $200,000.

Handlovitch suggested listing just below that amount with a nontraditional number. “I brought it down below what everyone expected the price to be and had over 30 showings and 11 offers, and it sold well over the price the seller had wanted to get for it,” he says. “We enticed people to come in, and then we created a feeding frenzy.”

Emphasize flexibility

Molly Wendt, CRS, an agent with Century 21 Randall Morris & Associates in Central Texas, likes to frame prices the way her father did when he was a broker. “When inventory was high, and a reasonable offer came in and the seller would not entertain it, Dad would say, ‘You just bought it back.’ It gets people to realize that they may be sitting on a property for some time if they don’t even try to work an offer or, better yet, price it right to begin with,” she says.

When buyers come into a house listed with Scott Furman, CRS, he tells the owners they’ll do one of two things: “Buy or not buy. Almost doesn’t count.”

Sellers who have unrealistic expectations or become attached to a certain price can sabotage themselves by refusing to work a good offer. Furman, broker-owner of RE/MAX Classic outside Philadelphia, manages client expectations by defining a range, not a specific number, when pricing a property.

“To talk about specific prices with clients can be dangerous,” Furman says. “You can be working with a buyer, and they can lose the property because you spoke about a specific number, and someone else was willing to pay more. You need to be able to look at a price range.”

In a fast-moving market, which many agents are operating in during the pandemic, home values can change quickly, making price a tricky thing to pin down. “When we look at data on what properties have sold for, we’re looking in the rearview mirror,” says Furman. That’s why he advocates for multiple appraisals. That way, the seller can get a low, medium and high point for their property and aim for the one that best meets their circumstances. If they’re looking to maximize profit, they may aim high, but if getting out of the house fast is a priority, they may aim lower.

The market prevails

The only truism that seems to transcend geographies and strategies is that the market is the ultimate price fixer. No amount of mind-bending or marketing is likely to sell a home that is priced too far from its appraised value. Sellers want to work with agents who have a track record of selling houses at a fair value quickly, not agents who have made a few unicorn sales.

Pricing Strategy Playbook

Adopting these effective pricing strategies and perspectives can help your clients optimize their selling price and distinguish between a strong offer and one with too many contingencies.

Double-dip pricing

Agents will usually take a buyer’s target price and broaden their search above and below it, says Khoi Le, CRS, broker and co-owner of Hunter Chase Realty in Albuquerque, New Mexico. He suggests rounding a list price to the nearest interval of $50,000 so that it falls within two budgetary ranges ($200,000–$250,000 and $250,000–$300,000, for example). If a home is worth $249,000, it may be wise to price it at $250,000.

Bidding war

Triggering a bidding war may be a good way to maximize selling price. Mark Handlovitch, CRS, associate broker with RE/MAX Real Estate Solutions in Pittsburgh, has used this technique and suggests that in addition to setting the price below what the seller hopes to make, agents can create interest and urgency by marketing a home without showings for a period. This creates interested buyers who feel encouraged to compete for the house.

Price skimming

When sellers want to overcome the influence of the other properties in their neighborhood, they may begin with a high price and gradually lower it over time. Le uses this strategy to test new markets and says it’s common for new construction in resale markets. As the price comes down, it attracts more price-sensitive buyers and maximizes the seller’s potential return.

Don’t let perfect be the enemy of the good

Sellers can become myopic when fielding offers and fail to consider factors beyond the dollar amount. A buyer willing to overlook certain details may be a better choice than one whose offer is higher but who wants concessions or accommodations. Molly Wendt, CRS, an agent with Century 21 Randall Morris & Associates in Central Texas, counsels sellers, “You can wait. You can counter back if you like. But if it’s a really strong offer without negotiations, take it.”

To uncover more pricing strategies, visit CRS.com/catalogsearch.

Photo: iStock.com/wildpixel