iBuyers are entering more markets across the country, and agents need to educate themselves on how these companies operate

By Regina Ludes

When she first learned about iBuyers through a webinar several years ago, Sonia Guardado, CRS, was skeptical.

The broker associate with Magnolia Realty in Round Rock, Texas, couldn’t grasp how iBuyers could help her clients or her business. “My first thought was, ‘Oh no, they’re going to come after our business.’”

After working with iBuyers on eight transactions in 2021, Guardado has changed her tune. She offers iBuyers as a solution for sellers with hard-to-sell homes who may not have the time or money to make repairs or can’t show their homes. That was the case of a client who needed to sell the home of her terminally ill mother. Guardado listed the house on Opendoor, and the deal closed shortly before the mother passed away.

After working with iBuyers on eight transactions in 2021, Guardado has changed her tune. She offers iBuyers as a solution for sellers with hard-to-sell homes who may not have the time or money to make repairs or can’t show their homes. That was the case of a client who needed to sell the home of her terminally ill mother. Guardado listed the house on Opendoor, and the deal closed shortly before the mother passed away.

“I’m here to offer solutions to my clients, and an iBuyer may be the perfect solution for them,” Guardado says.

The share of homes purchased by an iBuyer reached its highest level in 2021 at 1.3%, or 70,000 homes, according to the “2022 iBuyer Report” by industry analyst Mike Delprete. That figure is likely to grow as homeowners and agents become more familiar with them. They are especially appealing to sellers who dread having to clean their home, make repairs and host showings. Agents who understand what these companies offer can advise their clients on whether an iBuyer is the best solution for their housing needs.

What is an iBuyer?

iBuyers are companies that use algorithms to determine a home’s value and make an offer instantly, often without an inspection or showing. The “i” in iBuyer stands for “instant” because of the instant quotes they provide. They tout convenience for sellers who need to move quickly and don’t want the fuss of prepping the home for sale.

Opendoor was the first iBuyer on the market in 2013, followed by numerous others including Offer Pad, Redfin and Knock. Zillow entered the scene briefly but shuttered its iBuying business in November 2021. Real estate companies like Keller Williams and Coldwell Banker have launched in-house versions.

Opendoor was the first iBuyer on the market in 2013, followed by numerous others including Offer Pad, Redfin and Knock. Zillow entered the scene briefly but shuttered its iBuying business in November 2021. Real estate companies like Keller Williams and Coldwell Banker have launched in-house versions.

With so many iBuyers in the market, homeowners are bombarded with postcards, billboards and broadcast ads promoting instant cash offers. They’re confused and unsure of what to believe, says Kelli Phillips, CRS, broker owner with Kelli Phillips Realty Group in Marietta, Georgia, near Atlanta. She asks clients what they prefer—a quick sale or more money. If the answer is a quick sale, she knows she can explore the iBuyer option with them.

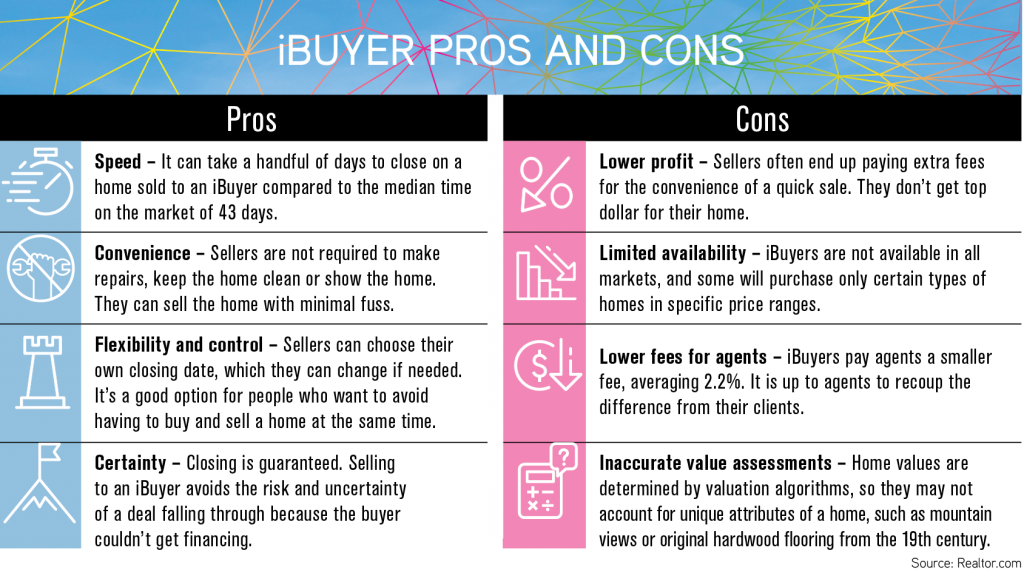

“I always tell them, ‘Here are your options,’ and I give the pros and cons of each. Then I let them decide,” says Phillips, who has worked with iBuyers for eight years and closed 20 iBuyer transactions last year.

When clients have questions, Guardado explains the iBuying process, but she recognizes that it may not be the best option for them. If the home is beautifully decorated and well-maintained, she’ll market it through traditional channels. However, if she sees that a home needs significant repairs, or if the client must move quickly, she’ll recommend an iBuyer.

She frequently works with Opendoor for those listings. If the client accepts the initial quote, she uploads photos of the property and gets a second quote. If that is accepted, an Opendoor rep visits the property to examine the exterior of the home, but not the interior, Guardado explains. The third and final offer may be adjusted by several hundred dollars, or much more if significant repairs are needed. However, quotes do not include Opendoor’s 7% fee, which isn’t added until the closing, Guardado says.

She advises agents to put their name on the listing and keep checking that it’s there. Guardado recalls losing a deal because her name no longer appeared on an iBuyer listing after 60 days. “If your name isn’t there, the homeowner can go back and claim the listing, and you would lose the fees,” she says.

Working with iBuyers—or not

The iBuyer market in 2021 was marked with excessively high instant offers, thanks in part to Zillow’s aggressive overbidding on properties. After Zillow shut down its iBuyer program in November 2021, other iBuyers learned from Zillow and began making lower bids.

These days, it’s more likely that sellers receive low-ball offers from iBuyers, and there’s little room for negotiation. Sellers must also pay iBuyer fees, usually 7% regardless if the home is already listed on the MLS or not, Guardado says.

These days, it’s more likely that sellers receive low-ball offers from iBuyers, and there’s little room for negotiation. Sellers must also pay iBuyer fees, usually 7% regardless if the home is already listed on the MLS or not, Guardado says.

“I think clients do themselves a disservice by accepting iBuyer seller offers outright,” says Kitty Stockton, CRS, a broker with RE/MAX United in Chapel Hill, North Carolina. She recalls a longtime client who received a quote on his home from a regional iBuyer in the South. Rather than accept the offer, the client opted to sell with Stockton, she says. Because there’s a severe housing shortage in the Triangle area, demand for homes is high. After several days on the market, his home received seven offers and sold at $90,000 over the quoted price from the iBuyer.

There’s no guarantee that the home being sold through an iBuyer will be in good condition either. Stockton worked with another client who found a home on Opendoor. When the inspection report determined that the home was in poor condition, the client refused to take the deal further. Stockton advised Opendoor and requested that the client’s due diligence money be returned. “I was shocked when I actually got the money back from the company,” she recalls.

Advantages for CRS agents

While iBuyer contracts indicate no negotiation on price, agents may find that these companies are willing to make deals. That’s because many homes sold through an iBuyer tend to be overpriced and linger for days or weeks on their sites.

“They may take less due diligence and earnest money up front and will negotiate on repairs. If you’re a buyer’s agent in a market with limited supply, it’s worth it to look at these overpriced homes for your client through an iBuyer. They represent opportunity,” Stockton says.

“They may take less due diligence and earnest money up front and will negotiate on repairs. If you’re a buyer’s agent in a market with limited supply, it’s worth it to look at these overpriced homes for your client through an iBuyer. They represent opportunity,” Stockton says.

While many agents may be hesitant to work with iBuyers, there are reasons to embrace them. They use many of the standard transaction forms plus a few of their own, which makes the iBuying process less daunting, adds Stockton. They’ve also hired licensed agents and MLS members to work for them, which should make agents more comfortable.

As these companies evolve, they’ve become more agent-friendly and offer different services to homeowners, such as trade-ins and bridge financing. A few offer agent referral programs with bonuses of up to $1,000 or 1% of the sale price at closing, depending on the transaction.

But Guardado cautions to read the fine print. “They’re not always clear about what they will pay you or when,” says Guardado, who participates in Opendoor’s agent referral program.

“iBuyers aren’t new to us, but they are new to our clients,” says Phillips. Agents who educate themselves on what these companies offer can help clients determine if an iBuyer is the best solution. “Clients can still need us and use these platforms.”

Understand the iBuying industry by taking the eLearning course “iBuying: Work With It, Not Against It,” available at CRS.com/education.

Photo: iStock.com/ipag/Lidiia Moor/IP Galanternik D.U.