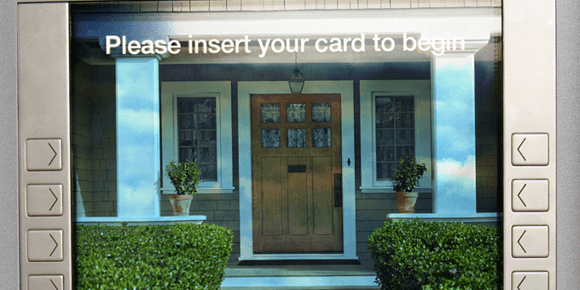

REALTORS® can provide a valuable service to seniors considering a reverse mortgage.

By Cheryl Winokur Munk

Some REALTORS® are warming up to the idea that reverse mortgages can be a lifeline for select elderly clients and are trying to help them better understand their options.

Reverse mortgages provide supplemental income to seniors age 62 and older based on the value of their homes. The loan allows homeowners to access a portion of their home equity as cash. In a reverse mortgage, interest is added to the loan balance each month, and the balance grows. Borrowers don’t need to repay the loan until they sell the property, move or die, but they must continue to pay property taxes and homeowners insurance.

The most common type of reverse mortgage available today is a Home Equity Conversion Mortgage (HECM). This type of reverse mortgage is federally insured and overseen by the U.S. Department of Housing and Urban Development (HUD), affording borrowers greater protections than they had in the past. With an HECM, no matter how large the loan balance, borrowers or their heirs never have to pay more than the appraised value of the home or the sale price. If the loan balance does exceed the home’s appraised value, the federal government absorbs that loss and it doesn’t affect other assets of the property owner.

“There are several good reasons to consider a reverse mortgage, assuming you qualify,” says Peter Bell, president and chief executive of The National Reverse Mortgage Lenders Association, an industry trade group.

For example, sellers whose homes need significant work may benefit from a reverse mortgage to pay for pre-sale repairs, he says. Alternatively, a senior might want to use the proceeds from a reverse mortgage to buy a vacation home. A third option that was introduced by HUD in 2008, but is still not yet widely known, allows seniors to buy a new principal residence using loan proceeds from a reverse mortgage.

“Many seniors may not know how a reverse mortgage can help them, which is where informed REALTORS® can add value. “I would definitely bring up the option in cases where it seems like it might solve a problem for people,” says Judy Barrett, CRS, a solo broker in Kailua, Hawaii.

She recently worked with a couple moving from a townhouse to a single-family home. The couple took out a bridge loan to allow them to purchase the new property before selling the townhouse. When it sold, they replaced the bridge loan with a reverse mortgage on the new property. They now have a home with no monthly loan payments and a credit line similar to a home equity line of credit.

A REALTOR® can help seniors contemplate whether a reverse mortgage might be a viable option by asking a few basic questions. These questions include their age, how long they are planning to live in their home and whether they can afford their living expenses, property taxes and insurance. Depending on a would-be borrower’s age and situation, there may be better alternatives.

Recent Regulatory Developments

Greater protections for non-borrowing spouses

The U.S. Department of Housing and Urban Development and the Federal Housing Administration have recently announced changes that make it easier for surviving spouses who weren’t on the original loan to assume ownership and continue on as the borrower did. There are several stipulations though, so reading the fine print is essential.

Age of borrowers

HUD now allows qualified borrowers to obtain a reverse mortgage even if their non-borrowing spouse is younger than age 62, with the caveat that the loan’s principal amount will be actuarially based on the age of the younger spouse.

Tightened lending criteria

A new HUD rule from April 2015 states that lenders must now make a “financial assessment” to determine whether would-be borrowers have enough income to keep up with property taxes and homeowners insurance so they don’t default on the loan.

Overcoming Historical Bias

Over the years, reverse mortgages have gotten a bad rap. There have been numerous reports of seniors not understanding what they were getting into and eventually losing their homes to foreclosure. Nowadays, however, there are many more protections and more REALTORS® are recognizing the potential upside for certain clients.

Reverse mortgages are likely to continue gaining ground as more baby boomers reach the minimum age and many of these seniors have large amounts of equity tied up in their homes. Seniors took out 53,372 federally insured reverse mortgages between Oct. 1, 2014, and Sept. 30, 2015, according to HUD data. To be sure, the number of these loans has dropped precipitously since the Great Recession. In fiscal year 2009, for instance, there were 114,692 federally insured reverse mortgages. But recent data suggests a turnaround; The number of HECMs increased by 1,730 between fiscal 2014 and fiscal 2015.

“All REALTORS® should go out of their way to educate themselves about reverse mortgages. There is so much misinformation about them,” says Andrew Norton, CRS, an associate broker with RE/MAX Executives in Fairfax, Virginia. He took a class with a reputable mortgage loan officer several years ago and describes it as an eye-opening experience. After he met the age requirement and went through the required counseling, he decided to take a reverse mortgage on his own home.

When he comes across a customer he thinks might benefit from a reverse mortgage, he tests the waters. If the senior seems receptive, he explains more about the program. From there, he refers the customer to a mortgage loan officer and encourages the senior to meet with a financial adviser. HUD also requires would-be borrowers to meet with a specially trained counselor on its approved list —another safeguard that’s been implemented.

Coming Up Short

While reverse mortgages are considered safer than they were several years ago because of enhanced government protections, some REALTORS® are reticent to recommend them. Joan Hart, CRS, a broker associate with RE/MAX Partners in Steamboat Springs, Colorado, is the listing broker on a home in a short-sale situation as a result of a reverse mortgage. She’s been doing a lot of work and is incurring significant out-of-pocket expenses to get the house ready for sale. The wife died, the husband moved to assisted-living and the children have basically abandoned ship, and the government is eating the costs. “It’s been an experience,” she says.

Of course, not all reverse mortgages have such unfortunate endings. “Every homeowner’s circumstances are different and it’s important that people seek knowledgeable advice,” says Bell, the industry trade group president.

Learn how to secure your financial future by taking the CRS Course, Buying and Selling Income Properties. Register at CRS.com.