Keep your data and information safe from bad actors

By Caroline Heller

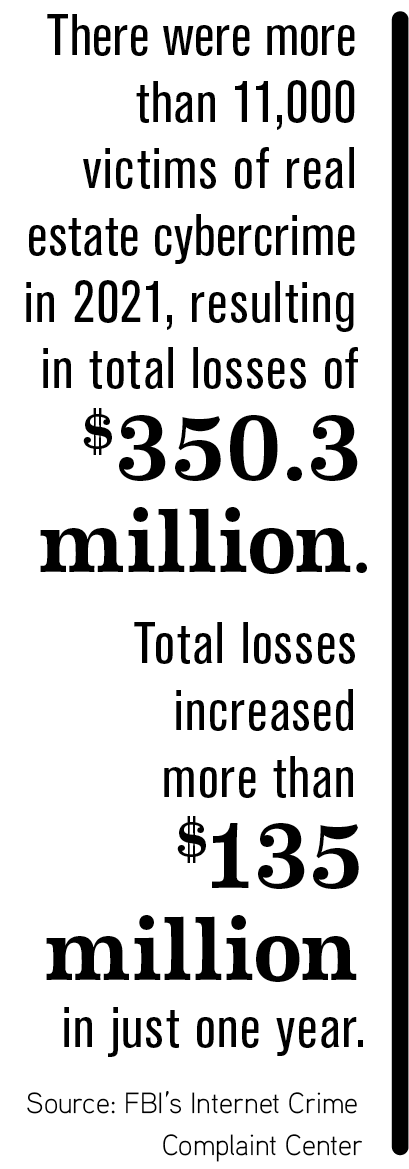

Cybercrimes are on the rise—especially crimes affecting real estate transactions and data privacy. According to the FBI’s Internet Crime Complaint Center, there were more than 11,000 victims of real estate cybercrime in 2021, resulting in total losses of $350.3 million. Even more shocking was that total losses increased more than $135 million in just one year. As more elements of real estate transactions move online and more technologies are being used to assist agents, a focus on data privacy and cybersecurity is necessary. Here we’ll examine how agents can keep their and their clients’ data safe.

Know how dangerous regular email can be

Know how dangerous regular email can be

Confidential information should never come through email. Use encrypted email or a document-sharing program to share this kind of sensitive information. You should also take extra precautions to ensure your passwords are safe. Sandy Workman, CRS, broker at Coldwell Banker in Bradley, Illinois, always makes sure her passwords are complex and different for each program or account she uses. “I’ll mix up names, numbers and special characters so that my passwords are random,” Workman says. “The more difficult you make it, the safer it is.” She also uses two-factor authentication to ensure only she has access to her accounts.

Don’t leave it open or out

Don’t leave your computer open or be signed into accounts when you’re not around. “I’ll walk into the office, and agents have their MLS up or their email, and they don’t sign out of it,” Workman says. “Some will even leave for the day with a computer still logged into.” Workman says she taught her kids an important lesson when they left a computer open with their Facebook account still logged into.

“I got on and posted ‘My mommy is the greatest mommy in the world,’” Workman says. “They learned quickly to log out of applications or close their laptop.”

The same thing goes for leaving important documents at fax machines or out on desks at the office. “I’ve seen contracts or preapproval letters left on fax machines for several days,” Workman says. “Those have all kinds of information that should be kept confidential.”

Limit details on social media

You should be wary about posting information on social media because those accounts are easy to hack and are also monitored by people wanting to send fraudulent wire information. “Even on social media I’d be careful about broadcasting specific financial information or prices,” says Rory Dubin, CRS, a broker manager at United Real Estate Gallery in Jacksonville, Florida. “It’s fine to say a transaction is closing, but when you start getting specific about dollar amounts, especially high dollar amounts, it’s going to attract the interest of people you don’t want.”

Educate clients about wire fraud and sending sensitive documents

You should also teach clients about the dangers of wire fraud.

“I tell my clients from day one, the minute I meet them, about wire fraud,” Workman says. She gives them a wire fraud document to sign that instructs them not to give financial information without anyone’s knowledge. Dubin also advises his clients against sending personal financial information to him directly.

“I typically tell the buyer to do all the financial pieces with their lender,” says Dubin. “The agent doesn’t really need that information; it’s really between them and their lender.”

Most Common Types of Cybercrime That Affect REALTORS®

Phishing is the attempt to obtain personal or confidential information, often by using a spoofed email address. A spoofed email address is a forged email sender address that appears to be from a trusted or familiar source. Often the messages will have links to malware or attempt to convince the recipient to provide confidential information, like passwords, name, address, Social Security numbers, etc. Phishing attempts can also be done through phone calls and text messages.

Malware is short for “malicious software,” which is a program installed on your computer without your consent, usually causing harm. Some common types of malware are keyloggers, spyware, viruses, tracking cookies, ransomware and adware.

Wire fraud is when cybercriminals use hacked or forged email accounts to send fraudulent wire instructions so that the money is sent to the criminal’s bank account. Rory Dubin, CRS, a broker manager at United Real Estate Gallery in Jacksonville, Florida, includes an important wire fraud alert in his email signature to inform clients of this dangerous crime that has been increasing over the past few years. The alert advises buyers and sellers “not to wire any funds without personally speaking with the intended recipient of the wire to confirm the routing number and the account number.”

Cyber attacks occur daily. Mitigate the risks by attending the classroom course “Protecting Your Business and Your Clients” at CRS.com.

Photo: iStock.com/D-Keine