By Victoria Cohen

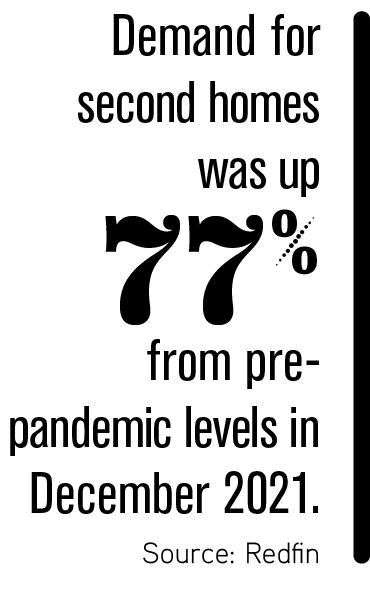

According to a new report from Redfin, demand for second homes in December 2021 was up 77% from pre-pandemic levels. When helping your buyers find their next opportunity or investment property, local taxes—and tax benefits, particularly—are important factors to consider. Buying a house can be expensive, so understanding the tax laws of the region is imperative when purchasing a property. Knowing where your clients will get the best advantages when it comes to taxes can help guide them in the right direction.

Nevada

Nevada is the ultimate low-tax locale, as there is no state income tax. Nevada’s property tax rates are also among the lowest in the U.S. The state’s average effective property tax rate is just 0.69%, which is below the national average of just over 1%. Homeowners are protected from steep increases in property taxes by Nevada’s property tax abatement law, limiting annual increases in property tax to a maximum of 3%.

Tahoe is a unique destination, a lake bisected by the state line. Beyond its natural beauty, Nevada is one of the handful of states that does not impose a state income tax, business tax or inheritance tax, offering residents considerable advantages when purchasing a property. In addition, Douglas County features the lowest real estate taxes of any county in Northern Nevada. For buyers seeking year-round amenities and considerable tax advantages, a Nevada address is a great choice.

Turks and Caicos

A legal tax haven, Turks and Caicos is often seen as the best place in the Caribbean to invest your money due to the British Rule of Law, where the British monarchy guarantees title to your property, and the U.S. dollar is denominated. There is no income tax, capital gains tax, property tax, inheritance tax or corporation tax in the Turks and Caicos Islands. Buyers purchasing homes in luxury communities can qualify to obtain permanent residency status. Stamp duty is a one-time fee of 10% of the purchase price of a property. Once it is paid, there are no further taxes associated with ownership.

The Bahamas

The stunning beaches, turquoise ocean and exquisite properties have attracted a very wide range of property investors to the Bahamas. The Bahamas has no income tax, capital gains taxes or inheritance taxes. Buyers at some resorts can benefit from the Bahamas’ Hotel Encouragement Act by enlisting their homes in their resort’s rental program on the property, saving in property taxes. Buyers investing over $750,000 USD in Bahamas real estate are eligible to apply for permanent residency. Homes and condos that are occupied by the owner have no property tax on the first $250,000; for the next $250,000, the rate is 0.75%, and the value over $500,000 is taxed at 1%, with a $50,000 ceiling.

For more popular tax topics, visit NAR.realtor/taxes.

Photo: iStock.com/terng99