Despite some credit and recession qualms, few view credit tightening as an imminent threat to REALTORS®

By David Tobenkin

These are boom times for many REALTORS®, but boom times can end quickly when homebuyer credit dries up.

Renee Reamer, CRS, was working in Baltimore during the Great Recession and remembers what happened to the local real estate market. “There were excessive offers for properties, and all of a sudden it came to a halt and it was all credit-related, the result of lenders in trouble,” says Reamer, a broker with Signature Reamer Realty, LLC, in South Florida. “There was no warning.”

Some recent developments have raised similar credit-related concerns among some REALTORS® and borrowers. In March, the Federal Housing Administration (FHA) raised eyebrows throughout the residential real estate industry, when, responding to increasing borrower and mortgage risks, it reinstituted the manual underwriting requirements for some riskier loans that it had removed in 2016. The net effect is that some buyers, who would have easily qualified for credit under automated underwriting, will now likely have to work harder to get a loan.

Three Local Views

REALTORS® express a variety of views on the availability and quality of credit as well as the threat of a recession.

- “I am not hearing of any credit or recession fears in our market—I am actually more concerned than my clients are about a recession. I do chat with them about how quickly and aggressively our market has appreciated, and I also share with them that some appraisers are [giving appraisals with values lower than the agreed-upon sales price]. Still, overall, credit is a lot tighter than prior to 2008, when anyone could get a mortgage.” —Mary Sherer, CRS, broker/owner at RE/MAX Crossroads in Fort Wayne, Indiana

- “The lending rules seem to have loosened a lot over the last year, possibly reflecting changes at the Consumer Financial Protection Bureau, which had previously made it very hard for borrowers to get loans [after the 2007–09 financial crisis]. I have not had problems with a lot of loans getting turned down. Actually, many buyers have been deterred because they believe credit is tighter than it really is. And I have not had one client mention a concern about a recession.” —Michael Inman, CRS, Coldwell Banker agent serving Lexington, Kentucky, and surrounding areas

- “If they ask, we tell clients that while there are rumors of a recession in the next year or two, we REALTORS® don’t see any signs of one. The market here is booming.” —Renee Reamer, CRS, broker with Signature Reamer Realty, LLC, who represents luxury properties in South Florida

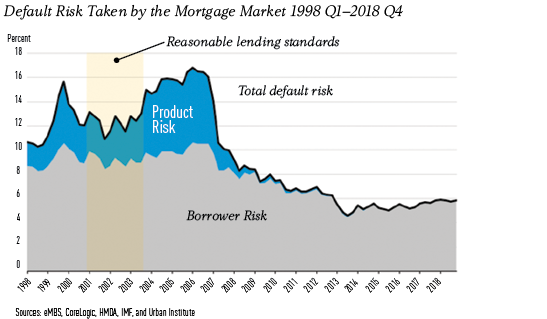

And there is additional evidence of some loan quality weakening. Some classes of residential lenders have seen substantial upticks in their risk profile in the last year, according to the Urban Institute’s Housing Policy Finance Center’s latest Housing Credit Availability Index (HCAI) update, which was released in April 2019. It measured the percentage of owner-occupied home purchase loans that were likely to default as of Q4 2018. In the portfolio and private-label securities (PP) channel of lenders, which includes banks and independent mortgage companies, total risk was 3.1% in Q4 2018, marking the highest level of risk since 2012.

So based on the credit forecast, are there choppy waters ahead for agents?

A Relatively Reassuring Big Picture

Even with lenders offering loans to less credit-worthy borrowers, credit conditions and lending standards are far stronger than in the heady days prior to the Great Recession, when speculators abounded and some lenders required little or no ability for borrowers to repay their loans. That makes a sharp correction like that of 2007 unlikely for the foreseeable future.

The Urban Institute’s fourth quarter 2018 HCAI showed that while overall mortgage credit availability increased to 5.85% (up from 5.75% in the previous quarter), that figure is still dramatically lower than the 16.5% in 2006.

“You could double the current default risk across all channels, and the risk would still be well within the pre-crisis standard of 12.5% from 2001 to 2003 for the whole mortgage market,” says Sheryl Pardo, a spokesperson for the Urban Institute. She says that in the current market, further extension of credit would be appropriate to enable more homebuying by buyers who cannot currently qualify. “Right now there is zero product risk—use of risky products like loans with balloon payments and no-document loans.”

“Credit conditions have been improving based on a variety of credit indicators we track, although the level of outstanding mortgages is still below the 2008 level,” says Gay Cororaton, a research economist at the National Association of REALTORS®. “If there are lender concerns about the state of the economy and credit quality, we are not seeing any downturns yet in credit availability, there is no overextension of credit and delinquency rates are low.”